Wake County Property Tax Rate 2024 Forecasting – While it’s very likely Wake County with a $1,176 property tax In 2024, it would be worth $300,000 with a $1,393 property tax In the same time, because of the lowering tax rate, tax bills . Call it a “WAKE-UP” call and all over social media, people were upset and flustered to see how much the value of their property has increased since the last valuation in 2020. The average residential .

Wake County Property Tax Rate 2024 Forecasting

Source : www.wake.gov

The Pate Realty Group, Wake Forest, NC Area | Wake Forest NC

Source : m.facebook.com

Raleigh Housing Market Trends and Forecast for 2024

Source : www.noradarealestate.com

Taylor Anderson Realtor/Owner Avenue Real Estate | Fuquay Varina NC

Source : m.facebook.com

Wake County homeowners brace for property tax adjustments: What to

Source : www.wral.com

Elliott Real Estate Pros | Raleigh NC

Source : www.facebook.com

Wake County 2024 revaluation: Information on property values

Source : www.newsobserver.com

Wake County unanimously passes $1.8 billion budget, property tax

Source : www.wral.com

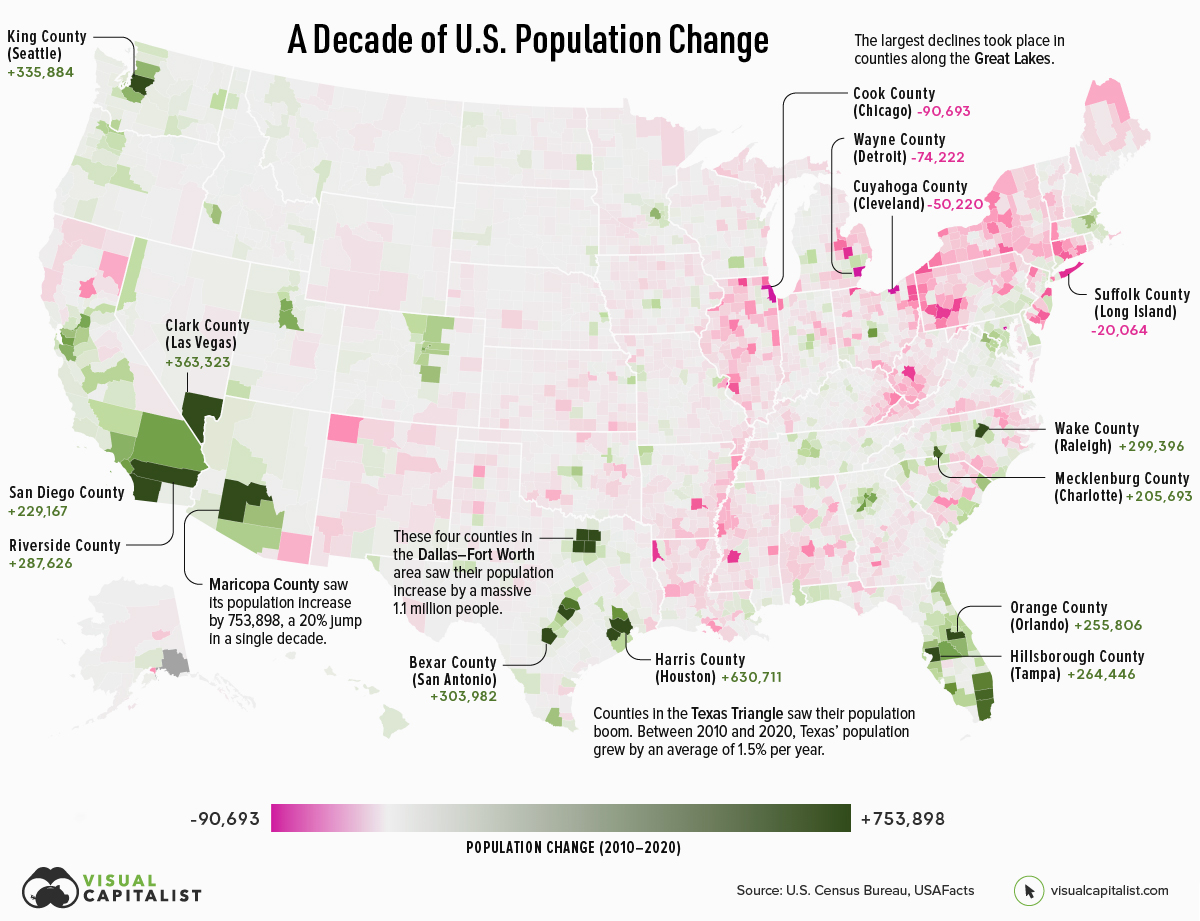

Mapped: A Decade of Population Growth and Decline in U.S. Counties

Source : www.visualcapitalist.com

Wake County unanimously passes $1.8 billion budget, property tax

Source : www.wral.com

Wake County Property Tax Rate 2024 Forecasting Fiscal Year 2024 Adopted Budget | Wake County Government: Homeowners in multiple towns across Wake property taxes jump later this year, as home values have spiked from four years ago, according to the latest property revaluations. Wake County’s 2024 . Wake County is estimating it will raise $1.4 billion in property taxes in fiscal year 2025, which runs from July 1, 2024 – June 30, 2025. Property tax is Wake County’s largest revenue source .